Covid the catalyst for ESG in credit

Issuers and investors alike are embracing Environmental, Social and Corporate Governance (ESG) as core financing or investment philosophies. Covid has acted as a catalyst for that higher ESG demand and longer-term, ESG will outperform as demand is insatiable and supply is lagging behind. Fund flows, supply and regulation are all pushing the trend

The shift from grey to green

When credit markets widen and concerns over Covid grew at the start of the pandemic there was a huge outflow from mutual funds that invested into credit. Some 30% of assets under management were withdrawn in a month or so. But the retracement of these funds has been strong and 2020 ended with net inflows. A closer look at this shows a very green picture as the initial Covid exodus has caused demand for 'green' to increase relative to grey debt. Fund flows inflowing into ESG have basically dominated flows and caused a shift from grey to green. Indeed in some cases, non-ESG funds have seen outflows over the last few years.

There's not been any major effect on the premium from ESG debt

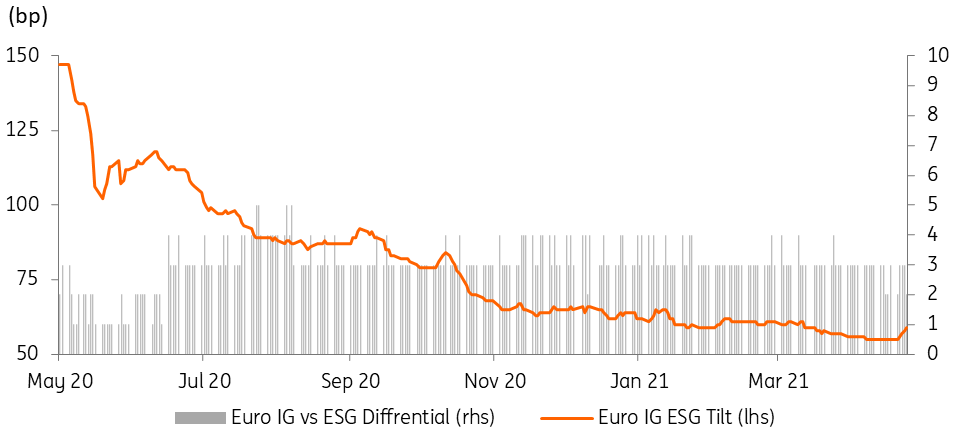

However, despite these inflows and the skyrocketing demand from investors, governments and central banks for ESG, there hasn’t been any major effect on the premium from ESG debt, as the market effect has been driven by the recent compression trade whereby anything with risk is of demand. This has driven spreads overall to very tight levels with little premium seen between different sectors, ratings and durations. And as such non-ESG has closed the gap with ESG bonds. Supply as a percentage of totals might have risen for ESG but it is hardly a flood and has not had any drastic effect on ESG spreads, despite a constant focus on ESG issuance.

| 85% |

Inflows of AuM into ESG Funds |

Fund flows

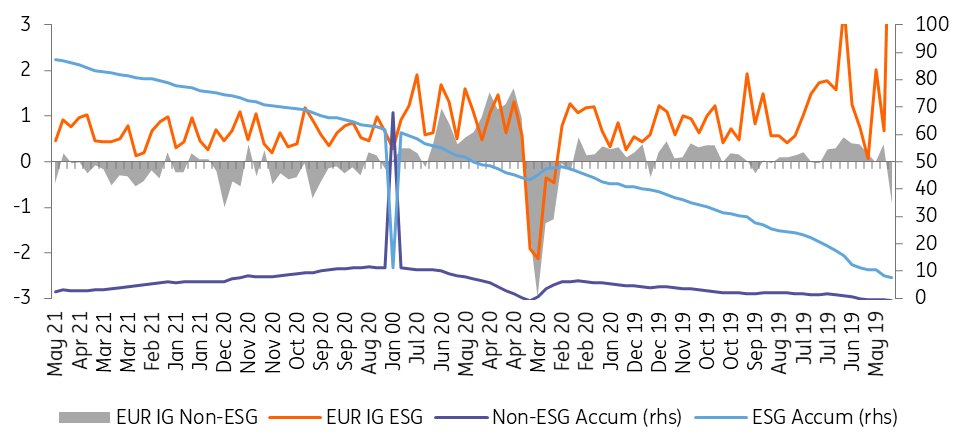

ESG funds are seeing very significant inflows. In fact, over the past two years, they've accumulated a substantial inflow of 85% of assets under management (AuM). Non-ESG funds have seen only marginal inflows, which has accumulated to just 3% of AuM over the past two years. And indeed, non-ESG funds have seen mostly outflows since August of 2020.

EUR credit and ESG fund flows

The majority of the inflows seen in Euro IG funds have been into ESG funds. In fact, non-ESG funds have generally seen outflows. It is also visible that most outflows seen from non-ESG funds have been swapped over to ESG funds in the same asset class.

EUR credit ESG fund flows account for most inflows

Unbalanced supply and demand in ESG market

The growing ESG market is still unbalanced in terms of demand and supply. Indeed there is a clear increasing and strong demand for ESG debt. However, the supply is still lacking in relative terms. Sustainable-linked bonds do offer an easier way for issuers to come to the ESG market. As the market grows, we will see normality and balance prevail.

The growing demand will indeed produce a 'greenium' (green premium). However, this is not currently being seen in the considerably tight environment in which we're trading. As the chart below shows, we can see that the compression of spreads has seen a smaller dwindling greenium. The differential between ESG and non-ESG in terms of spread is very little. This is mainly due to the compression trade we have seen in the past months, buoyed by the demand for risk.

ESG spreads vs overall EUR spreads

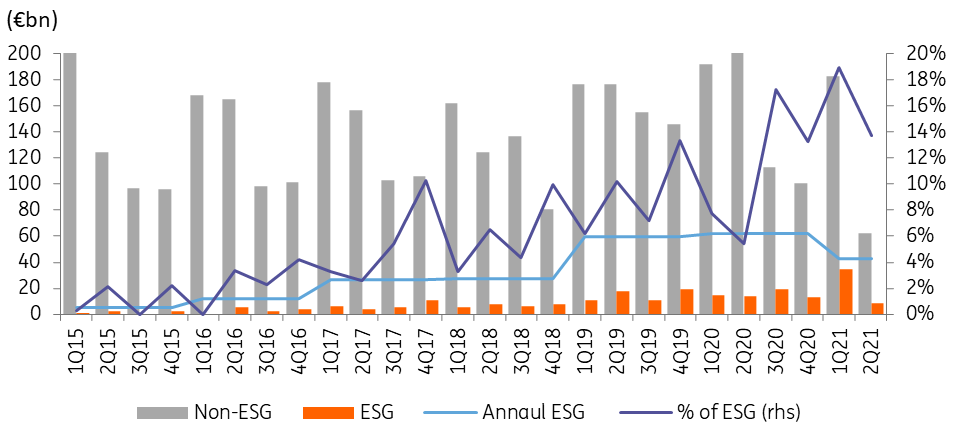

ESG supply is growing

The percentage of ESG supply to overall supply is also growing. The dark blue line in the chart below demonstrates this increase year on year. In both 2019 and 2020, total ESG supply accounted for 9% of the total overall supply. So far in 2021, ESG supply accounts for 18% of the overall supply. Of course, relative to last year, there is indeed more ESG supply and less overall supply.

EUR ESG supply vs Overall EUR supply

| 18% |

of overall supply has been ESG in 2021 |

However, the large increase in that ESG supply percentage has not had a detrimental effect on spreads, despite there being very little in the differential between ESG spreads and overall EUR spreads. We feel supply can and will be easily absorbed by the market.

ESG supply has consistently been increasing. Already there has been €21bn in corporate ESG supply this year, running ahead of last year’s €16bn. Financials have supplied €20bn thus far this year, up significantly from the €5bn supplied last year YTD. Last year pencilled in €64bn in total ESG supply, of which €39bn was from corporates and €25bn from financials. We forecast ESG supply to reach at least €50bn in Corporates and €50bn in Financials.

EUR ESG supply in corporates and financials

Between 2016 and 2019, the vast majority of ESG supply was done in the utilities sector. Recently, ESG bonds have become more sector diverse. Sectors such as Real Estate, Autos and Industrials are seeing significant ESG supply. That said, utilities are still the largest sector for ESG supply. So far this year, €8bn of the €22bn ESG supply has been from the utilities sector. However, the supply of ESG bonds will continue to see notable growth as core names and more sectors get involved in issuing ESG debt

Percentage of ESG supply to overall supply per sector

Sustainable linked bonds

We see the sustainability linked bonds market as the fast-food of ESG bond finance compared with the 'white linen tablecloth' variety of green bonds which are best associated with a Michelin-starred restaurant where everything is perfectly laid out. By which we mean, sustainability linked bonds are significantly easier, simpler and quicker to issue and as such these bonds are certainly gaining traction. Last year saw €3.5bn in supply. Already in 2021, €3.3bn has been supplied.

We see this as supportive in a number of ways:

- It allows more issuers to tap ESG demand as the process of issuance is far less complicated. This will be particularly advantageous for less frequent issuers.

- It adds more volume to the ESG market as a whole as an alternative to a green bond. The ESG market is certainly growing year on year. However, there is still a balance issue relative to the strong demand for it.

- It is still ECB-eligible. The ECB has included a provision to work around their guidelines in which debt with a step coupon is in principle ineligible as collateral, by making step coupon bonds eligible if they are tied to ESG targets.

However, the question still stands; where would these issues sit in the new SFDR framework, and in what type of portfolio?

ESG investment plans for all

The ESG trend has been continually in a state of growing popularity. Investors, governments, central banks alike are all putting investment plans in place to become more ESG driven. Many are setting green targets from both an issuance point of view and an investment point of view.

- The ECB has been pushing their agenda for climate change in many aspects, one of which is increasing and concentrating ESG asset purchases under both APP and PEPP. As it stands, the ECB holds 139 ESG corporate bonds, purchased under CSPP and PEPP. This accounts for 8% of the total corporate purchased from the ECB. Nonetheless, this is still a substantial chunk of the eligible ESG market. In any case, the ECB is certainly becoming a greener investor.

- The European Union announced a new programme for sustainability bond issuance. In the coming five years, the total “NextGenerationEU” bond issuance will amount to €800bn, of which 30% (€250bn) will be green bonds.

- Furthermore, a large increase in taxonomy aligned ESG supply can be expected once the EU has finalised the European green bond standard.

- In the U.S. President Joe Biden plans to spend a trillion dollars over the next 8-years on sustainability projects, and the expectation is for considerable public-private partnership ambitions.

- The SFDR basically promotes ESG investment philosophies and processes and thus encourages issuers to follow that investment need. Besides, NFRD and SFDR disclosure requirements will make it increasingly easier for non-financial and financial corporations to identify and select sustainable assets on their balance sheets in favour of ESG issuance.

We've written more about this here

In conclusion

The ongoing trend in the focus for ESG will continue to grow. It is clear the crisis has been a notable catalyst for ESG demand. The fund flows into ESG is considerable, particularly as many flows are moving from non-ESG funds into ESG funds.

With the growing demand from investors, governments and central banks, supply will continue to be at the forefront, with regulatory initiatives such as the EU taxonomy and disclosures regulations only pushing demand further into that direction. ESG supply is already gaining major traction and has become more diverse with the likes of sustainability linked bonds and new sectors joining.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article